Lake County Ohio Income Tax

If you have any questions or need.

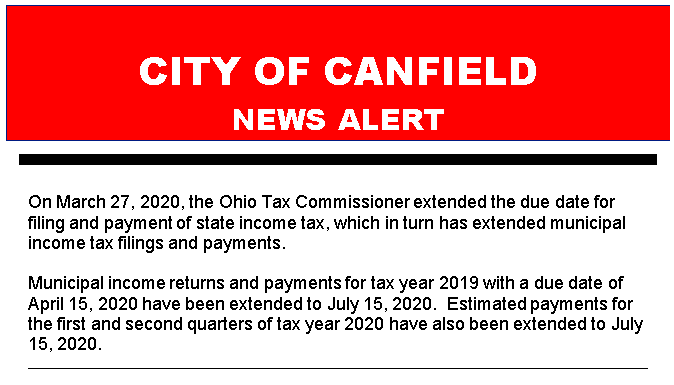

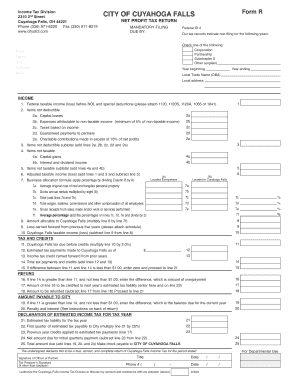

Lake county ohio income tax. Real estate taxes tax rates special assessments. Tif tax increment financing. The basic ohio estate tax is levied against the value of a resident decedent s gross estate less deductions and exemptions. Lake county collects on average 1 54 of a property s assessed fair market value as property tax.

Lake county ohio auditor taxes. Lake county collects a 1 25 local sales. The median property tax in lake county ohio is 2 433 per year for a home worth the median value of 158 100. Lorraine fende lake county treasurer 105 main street painesville ohio 44077 office open 8 00 am to 4 30 pm monday thru friday holidays excluded phone.

440 350 2516 painesville 440 918 2516 west end and cleveland. Please call us at once if you did not receive your bill or if you have any indication that your tax bill may have been misdirected. The lake county ohio sales tax is 7 00 consisting of 5 75 ohio state sales tax and 1 25 lake county local sales taxes the local sales tax consists of a 1 25 county sales tax. The lake county sales tax is collected by the merchant on all qualifying sales made within lake county.

Groceries are exempt from the lake county and ohio state sales taxes. The lake county council passed a 1 5 percent income tax monday night and county commissioners declined to veto it friday morning setting in motion the new tax s gears. The county auditor acts as an agent for the tax commissioner of ohio and is responsible for the distribution of the estate tax for those descendents who resided or owned property in lake county.