Lake County Ohio Sales Tax Rate

Click here for a larger sales tax map or here for a sales tax table.

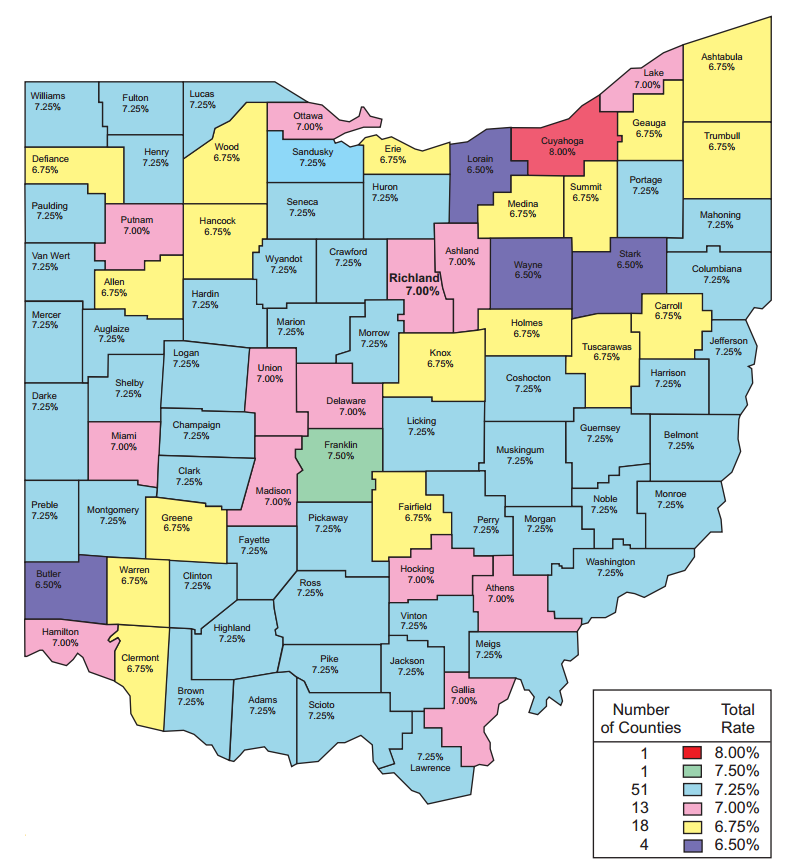

Lake county ohio sales tax rate. By county by county effective april 1 2020effective april 1 2020 number of counties 1 2 56 13 13 3 rate new rate. The 2018 united states supreme court decision in south dakota v. Lake county tax rate 7 25 previously 7 00 note. The lake county sales tax rate is.

Painesville oh lake county treasurer lorraine fende and lake county auditor christopher galloway announced today the process for taxpayers struggling financially due to the covid 19 pandemic. The lake county sales tax is collected by the merchant on all qualifying sales made within lake county. If you need access to a database of all ohio local sales tax rates visit the sales tax data page. The ohio state sales tax rate is currently.

The minimum combined 2020 sales tax rate for lake county ohio is. This is the total of state and county sales tax rates. Groceries are exempt from the lake county and ohio state sales taxes. The finder this online tool can help determine the sales tax rate in effect for any address in ohio.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Other rate change information. Ohio has a 5 75 sales tax and lake county collects an additional 1 5 so the minimum sales tax rate in lake county is 7 25 not including any city or special district taxes. The lake county ohio sales tax is 7 00 consisting of 5 75 ohio state sales tax and 1 25 lake county local sales taxes the local sales tax consists of a 1 25 county sales tax.

Rate schedules these tables illustrate the correct sales or use tax at a given tax rate and price. Lake county treasurer 105 main street painesville ohio 44077 office open 8 00 am to 4 30 pm monday thru friday holidays excluded phone. The latest sales tax rate for madison oh. Ohio has 1 424 cities counties and special districts that collect a local sales tax in addition to the ohio state sales tax click any locality for a full breakdown of local property taxes or visit our ohio sales tax calculator to lookup local rates by zip code.

This table shows the total sales tax rates for all cities and towns in lake county including all. Ohio has state sales tax of 5 75 and allows local governments to collect a local option sales tax of up to 2 25 there are a total of 553 local tax jurisdictions across the state collecting an average local tax of 1 38. Small portions of delaware fairfield licking union counties assess a transit authority sales tax levy of 0 50 not reflected on this map montgomery 7 50 miami 7 00 lake. 2019 rates included for use while preparing your income tax deduction.

The sales and use tax rate for hamilton county 31 will increase from 7 00 to 7 80 effective october 1. Lake county collects a 1 25 local sales. Combined with the state sales tax the highest sales tax rate in ohio is 8 in the cities of.